Alumna Deeann Griebel Happy to Support SMSU With $1.8 Million Commitment

Published Friday, February 26, 2021

Deeann Griebel still drives to work in the maroon 1975 Chevy Caprice Classic she bought in Pipestone. When purchased, the odometer read 125 miles. Today that number is 368,000. The car has been restored twice, and is on its second engine, third transmission and fourth radiator. It’s in immaculate shape. “I smile every time I look at her,” said Griebel, a 1980 alumna who recently committed $1.8 million so Southwest Minnesota State University.

Griebel is the managing director of investments for Moors & Cabot, Inc., in Mesa Arizona, a state she moved to shortly after earning her accounting degree from SMSU.

Why Arizona? “It dawned on me that I could fit everything I owned into my car. So I went to the library and grabbed an Atlas. I asked first, what do I want? Then I asked what don’t I want? I didn’t want snow, so that eliminated everything north of the Mason-Dixon line. I don’t like humidity, so that’s everything east of the Mississippi. Texas had a late blizzard in ’80 so that was eliminated. California was in a recession; and there’s no place to go in New Mexico. That left Nevada, Utah and Arizona. I like small college towns like Marshall, so I turned the Atlas to Arizona, and there was a photo of the Gammage Auditorium, a massive performing arts center on the Arizona State University campus. Keep in mind it was a much smaller college back then. I love theatre and the performing arts, so I said I wanted to live within five miles of the Gammage Auditorium.”

As luck would have it, the bus driver who transported Griebel and her sister to school from first grade through their senior year had a trailer four miles east of Gammage. “He decided he wasn’t coming to Arizona that year because of his age, so I bought it.”

She received business education and PE degrees from St. Cloud State and taught for three years before attending SMSU for her accounting degree. “I kept getting laid off,” she said. “That’s when a huge amount of baby boomers were coming out of high school and so many of those schools saw their graduating class of seniors go way down. Business education classes were electives and the first teachers laid off were those teaching electives. I thought I’d better change careers.”

She would live with her late sister Deb during the summer months while pursuing her accounting degree at SMSU.

She earned her CPA certification in May of 1980, graduated in June, moved to Arizona, and on Sept. 6 began a job with a local CPA firm Finger, Seiter and Kaplan. It was only 11 months later, when doing an audit, she uncovered a discrepancy that led to the discovery of embezzlement by the company treasurer over a 20-year period. “It was a mess, and to clean something like that up it takes a couple of years. I was hired on as a comptroller, so took a two-year sabbatical, thinking I was going to go back as an accountant.

“During that two-year period the firm’s owner asked me to look at some investments, and it turned out those were frauds. If the good Lord game me a gift, it’s the ability to sense when something’s wrong — that the numbers don’t add up.”

She’s run across 16 instances of fraud during her career, “and my dad used to say, if you know a fraud is hurting someone and you don’t try to stop it, then you are participating in the fraud.”

She was set to go back to her accounting position, but learned a few things over the previous two years. “I was aware you don’t make much money in public accounting until you are a partner. And that men don’t like female partners, something that’s true today,” she said.

She moved into financial advising instead, joining Thomson McKinnon Securities in 1983. In 1988 she learned Thomson McKinnon Securities was at risk of going bankrupt, so she joined Prudential Bache Inc., which later changed its name to Prudential Securities, which was taken over by Wachovia Securities, which was taken over by Wells Fargo Corporation. She had a “parting of the ways” with Wells Fargo in 2013 and joined Moors & Cabot in October of that year.

As a result of her $1.8 million commitment to SMSU, the Student Success and Advising Center will be renamed the Deeann Griebel Student Success Center. Her gift will support innovative tutoring and mentoring programs, something Griebel is enthusiastic about.

“I’m close to Arizona State, now the largest university I think in the world. They’ve been working on this concept of students helping students. When President Jayasuriya mentioned that, it made perfect sense to me. Having students teach other students is a great idea. It will help one student understand the material in a deeper sense, while helping other students get over a roadblock and help them stay engaged. If you can get a student through a subject they are ready to give up on, who knows where that student will go? I’m a big believer that one person can change the course of history.”

Griebel started out as a teacher, left the profession, only to return, in her own way. “I like teaching, and helping the public. By being a financial advisor, I am helping people. Much of what I do is explaining things to clients and keeping them out of the latest fraud. It’s a way of teaching.”

She will present a program, “Getting Your Ducks in a Row to Avoid Conflict When You Are Gone,” an estate planning seminar, on Saturday, April 10 via Zoom from 11 a.m.-12:30 p.m. The event is sponsored by GOLD College. Those interested can RSVP to receive the Zoom link at: goldcollege@smsu.edu.

She’s had a successful career, and has been a six-time selection to the Barron’s Top 100 Women Financial Advisor list since 2007. She has a positive outlook, and energy that won’t stop. She attributes much of that to a weekly workout routine that includes 12 miles of running, another 15 walking, 100 miles on a stationary bike, swimming three miles, and weightlifting three days. “My doctor said I have a biological body of a 39-year-old,” she said. “I was too lazy to get married and too lazy to have kids, so I have more time than most.”

Griebel, an Alumni Achievement Award winner in 2006, is a strong SMSU benefactor, and sees the value in investing in the next generation of students. She’s concerned with what the pandemic has done to students the past year, especially younger students, and encourages others to support the university in their estate planning, as she has done.

Related Articles

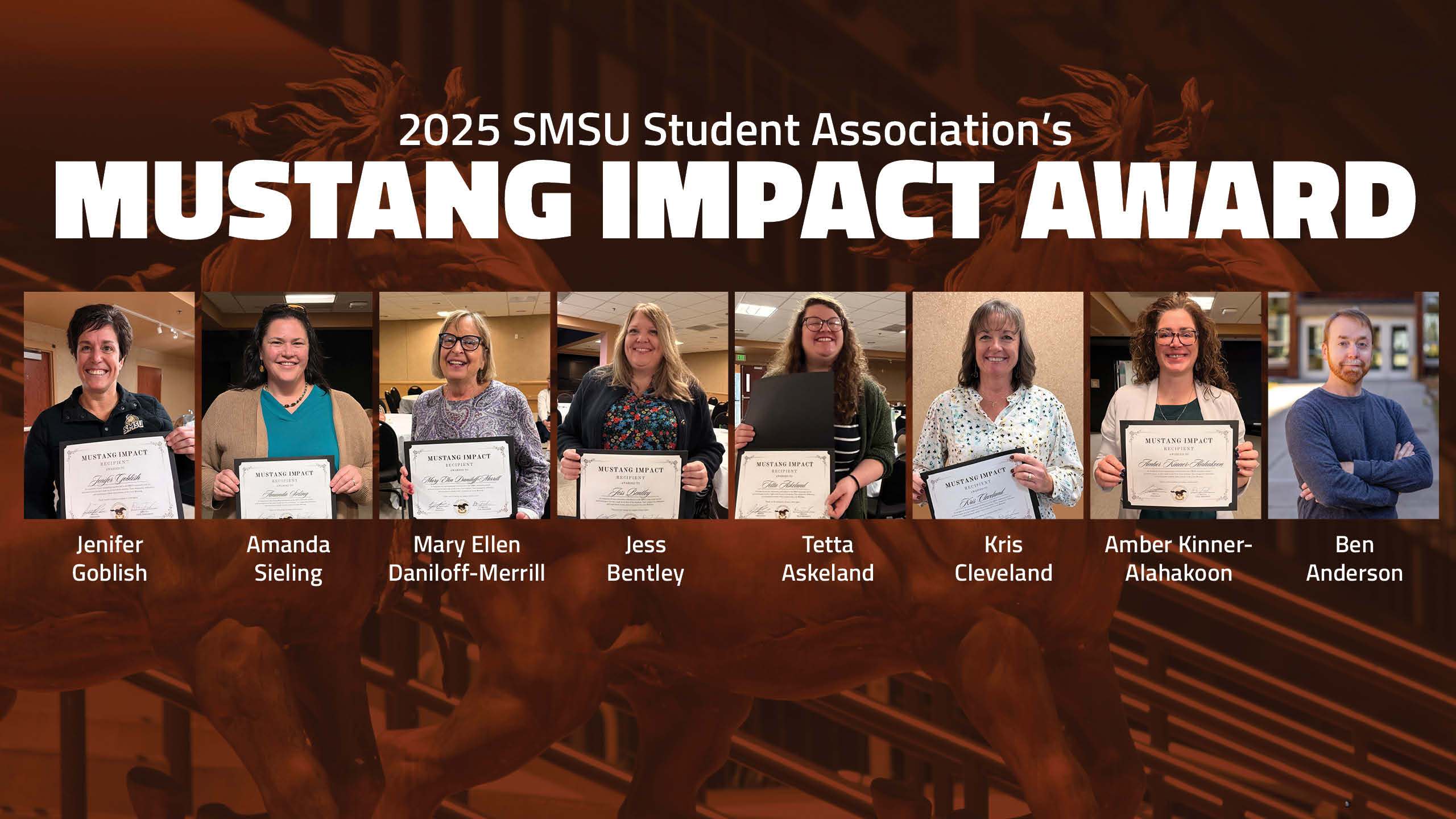

Student Association Presents the First Cohort of Mustang Impact Awards

Posted on 11-26-2025

SMSU to hold 20th Annual Undergraduate Research Conference on Dec. 3

Posted on 11-21-2025